In the first half of 2025, the new Eurosystem Collateral Management System (ECMS) will change the way you interact with central banks to post collateral and receive credit. Euroclear clients will be able to benefit from this new initiative without having to implement significant changes to their current operational setup.

Accessing central bank liquidity in Euroclear Bank

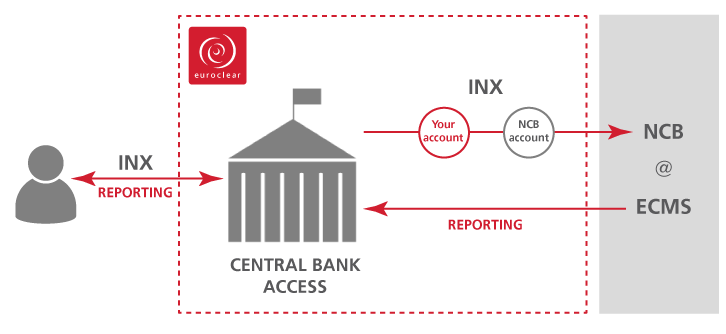

Euroclear Bank clients can keep things simple and continue to benefit from seamless access to central bank liquidity.

While settlement will take place in T2S, you can continue to operate your account with us as you do today; we will deliver collateral to the NCBs in T2S on your behalf - eliminating the need to implement costly and complex operational changes.

Our new Central Bank Access service does away with the need for you to send instructions to both the CSD and ECMS. You can outsource the management of all aspects of bilateral settlement with NCBs - giving you new opportunities to:

- streamline your operations with straight-through processing

- increase end-to-end efficiency in the mobilisation and demobilisation of collateral with NCBs

You can also benefit from triparty-like functionalities while we take care of the bilateral-settlement processes of the NCBs.

For the mobilisation of collateral, simply send your instruction to us – as you do today – either using MT527 or EasyWay. We:

- select collateral on your account and deliver it to your central bank

- send the necessary mobilisation requests for ECMS to accept delivery of the collateral

- provide you with consolidated reporting

- collateral management reporting through the MT569 or the Margin Report

- substitutions performed automatically in an event such as an asset being required to meet your settlement obligations or no longer being ESCB eligible

- easily adjust the amount of collateral you post to the NCB

ECMS will change the way to interact with central banks to post collateral and receive credit. This includes:

- bilateral settlement: the requirement to send instructions to both the CSD and ECMS

- mandatory settlement in TARGET2-Securities (T2S): all collateral delivered to a Eurosystem NCB will have to be settled through T2S and will have to be held by the NCB in an account with a CSD on T2S

- ISO 20022: ECMS will only accept ISO20022 SWIFT messaging

- SCoRE: ECMS will only process collateral in accordance with the Single Collateral Management Rulebook for Europe (SCoRE) - a set of post-trade standards for marketable securities

Replacing the current fragmented landscape is in line with other European initiatives aimed at developing common platforms and systems that work across the euro area with the aim of developing a robust common capital markets infrastructure.

ECMS will deliver significant operational and cost efficiencies to the European financial markets. It will ensure that:

- NCBs implement collateral framework changes simultaneously and identically

- counterparties will no longer have to interact with different local collateral management systems

- the market benefits from a single system managing the pools of assets used as collateral in Eurosystem credit operations, including auto-collateralision

As an FMI, Euroclear Bank is committed to ensuring the stability and sustainability of financial markets.

We have already signed an agreement with the European Central Bank (ECB) and the central banks of the euro area to join ECB’s TARGET2-Securities (T2S) settlement system. The Euroclear Bank–T2S connection will provide you with access to one single pool of liquidity and collateral - across multiple currencies and jurisdictions.

You’ll continue to benefit from our existing asset protection and high-quality service levels in collateral management and asset servicing.

Furthermore, our new Central Bank Access service will offer a solution that will reduce your operational burden in the post-ECMS environment.