As a cross-border Financial Market Infrastructure (FMI), Euroclear enables and facilitates the connection of issuers and investors around the world through activities such as cross-border payments, settlements and collateral management.

Our mission is to support and enable a sustainable financial marketplace, while limiting our impact on the environment, providing an equitable and inclusive workplace and conducting business in an ethical and responsible way.

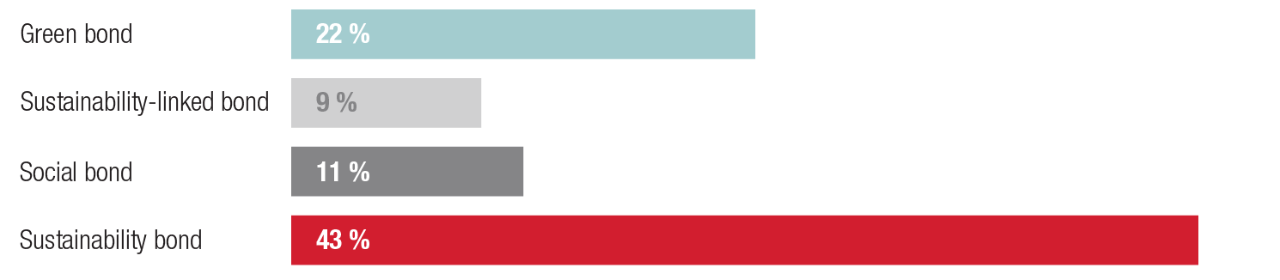

Did you know that in 2024, over EUR 369 billion in Green, Social, Sustainability and Sustainability-linked (GSSS) bonds were issued in Euroclear Bank?

By the end of the same year, over EUR 1.5 trillion in GSSS bonds were held under Euroclear Bank’s custody.